Control of Wealth is Control of Government

Unwise Spending Destroys Government

Americans are poorly taught, probably purposefully, about the relationship of money to wealth and of money to government control; i.e., to Control Wealth is to Control People. Samuel detailed to the early Israelites the dangers of wealth to government control (1Sa 8:9-22). God through Moses warned the Hebrews that government should not control too much wealth, military technology or entangling alliances; they were to be different from all other kingdoms evidenced by their submission to God (De 17:14-20). Solomon, who was supposed to be wise, ignored all warnings, overburdened the people as Samuel warned and caused the kingdom to be divided after his death (1Ki 10:23-11:13). This self-destruction of national sovereignty would plague empires in the ancient world and find disciples in the modern world who seek globalization via the control of wealth.

Wealth: Defined by Land and Goods

Coinage: First Separation from Wealth

Until approximately the 6th or 5th century B.C. when coinage was developed, wealth was defined by land and goods. Job was considered wealthy because of the size of his various herds (Job 1:1-3). Loyal, productive subjects were rewarded with productive land making the owner wealthy do to agricultural production. Gold and silver were used in some degree but do to the enormous amount of labor necessary to mine, refine and fashion these metals, they were usually limited to government officials of various levels. It is vital to understand from Samuel’s description that governments do not produce wealth; they consume wealth to display power. Nearly from its inception, coinage was inscribed with governmental emblems showing ownership; the above coin depicts Nero, Roman emperor during the mid 1st century.

Coinage represented the cost of goods and services against the demand for such goods and services. Even though the coinage was minted in gold and silver, valuable in themselves, they were removed from the goods. Rich became a concept represented more by the amount of metal one controlled and less by the products and services one produced. This separation was a gradual process taking many centuries. Originally, gold and silver were measured by weight and coins generally followed this custom. Whereas the value of gold, silver, goods and services were generally controlled by market forces; governments were constantly looking for ways to increase their power by manipulating coinage. Early on governments attempted to control wealth by skimping on the amount of precious metals in coins by substituting other metals such as lead. This magnified the concepts of deflation and inflation. Deflation increases the value of coinage but significantly fewer people have access to coinage: poverty increases. Inflation is a decrease in value of the coinage which requires more coins to purchase the same amount of goods and services: poverty increases. Some governments sought to liberate themselves from the slavery to the value of commodities: paper money was born.

Federal Government Issued Greenbacks

For People to Use When Gold Became Scarce

Chinese were the first to experiment with non-metallic money during the Han dynasty: Deerskin notes {Ancient History Encyclopedia. Coinage.}. America’s federal government introduced paper money, Greenbacks, during Lincoln’s War as gold and silver became more scarce. Paper money is the next step removing people from the concept of wealth representation and introducing them to the power of the state which prints the money. These were easily counterfeited, becoming worthless and very unpopular causing them to be discontinued after the war. However, the concept gained resurgence with the introduction of gold and silver certificates {Collector’s Weekly. US Gold Certificates.}. People slowly accepted paper money with the promise of redemption in gold or silver coinage. During the Depression, FDR made private ownership of gold illegal, except for jewelry, making people totally dependent on paper money. When it became legal to own gold again there was little impetus to return to gold coins; paper money was here to stay in America.

Value of Gold Controlled by the Market

Value of Fiat Money Controlled by Debt

The Federal Reserve is not a part of the federal government; it is a private central bank with the solely authority to print money in the form of Federal Reserve Notes (FRN). The term fiat money means that the value of the FRNs are determined solely by the say-so of the Federal Reserve through the power of the Federal Government. Finally, money is totally separated from wealth in any form. In fact, FRNs are printed based on loans which are liens against future tax receipts. Thus, FRNs are based on debt which means they start depreciating the moment they are printed and more are printed to offset this depreciation which is inflationary. This is a hidden tax on every person who uses fiat money which is the most common form of money in the world.

Thus, the concept of wealth today simply means possessing money whose value is determined only by government decree or fiat. The power of wealth which originally lay with the producer has now been transferred to the government. The people exchange their goods and services for debt which enslaves them to the government and its continuation. If the government fails then the fiat money fails. The soundness of national currency is directly tied to the economic stability and projection of power of the national government to protect trade markets. Yet, there are other forces at work undermining this closed loop.

Extending easy credit in the form of plastic credit cards trained Americans to accept continual debt and to view all money as limiting their access to stuff. People could enjoy nearly all the pleasures as the very rich with simple monthly payments. this further prevented people from understanding the linkage between wealth and money. With debit cards people became trained to use plastic in everyday transactions and eschew cash altogether. The explosive growth of digital technology facilitated this transition bringing everyone into the digital age by introducing the concept of digital money or cryptocurrency. While some people experimented with bitcoin, it has not become widespread because it operates outside of governments, reducing their power over transactions. And, the explosion of identity theft has kept people from embracing cryptocurrency.

Imagine if Your Identity was linked to You

You could prove Your ID with any cell phone

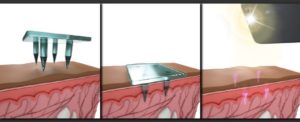

During this Covid-19 pandemic Congress has tried to implement the transition to only a digital currency. Research has been ongoing in other nations developing means to cost-effectively insure everyone’s identity and track financial transactions, health compliance and other criteria yet to be determined. The simplest device is a illustrated above. Each person would receive a code unique to their identity in the form of invisible ink that could be detected via an app and cell phone. You would be the verifier of you. Since money is dirty and can carry disease, a transition to cryptocurrency approved by the government would reduce disease transmission. Every transaction would be digital and thus open to government scrutiny and control. Spending on non-approved goods and services could be denied. Your digital money could disappear should you be deemed subversive by the government. Government would know if you had obtained your required vaccine or restrict your access to healthcare if you are deemed non-productive by the state. The possibilities are endless.

As people demand government to provide their daily bread and as national government debt-based spending escalates a point will be reached when this must implode causing wide-spread sovereign governments to fail. Just as the people looked to their government, these governments will look to a centralized power to prevent their failure: Globalization will proceed with the consent of the governed. Centralized digital control to the individual level will determine who receives scarce resources; who is approved. Whereas this process was previously insidious, it now proceeds openly under the guise of health and equality. Those who are at the very top will not trade in anything so crass as cryptocurrency or stocks; their wealth lay in their power to control as mankind returns to serfdom just to survive (2Th 2:3-12).